We are pleased to present our quarterly analysis of the venture debt market, sharing our observations on the most recent habits of lenders, clients, and general trends within this ecosystem in which we live. As you can imagine, what might have been the general content of this report has changed a bit these last couple weeks of March…in any case, let’s dive in.

In this report, we’ll cover:

- The State of the Venture Debt Markets

- The Deals Getting Done Today

- Top Use Cases for Debt

State of the Market

The venture debt markets have been complicated by dueling factors: the increasing cost of debt against the skyrocketing cost of equity capital due to lower valuations…and the recent collapse of venture debt giant Silicon Valley Bank.

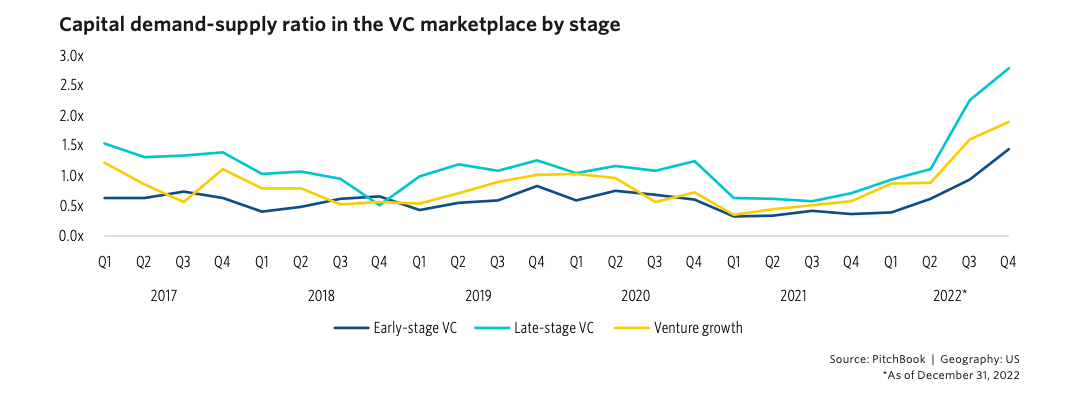

Companies have been increasingly moving toward debt as a valuable capital option over the past few quarters as valuations continue to remain depressed. Pitchbook's research estimates that "2.1x the amount of capital is being demanded by VC-backed companies than is actually being supplied at the moment", leaving founders and existing investors desiring a non-dilutive option to fund the company until markets rebound.

With the exit of SVB from the active lending scene, many companies have been left either looking for capital to replace their SVB facility or at the very least rethink their capital strategy.

Companies are continuing to reconfigure their costs and manage expenses to extend runway as much as possible. As a result, debt is an increasingly more attractive strategy as companies look to continue investing in their growth this year in order to achieve a stronger return to the equity markets for a raise or exit in 2024.

The Market for Venture Debt Terms

It’s no secret that the terms and costs for debt have changed from a year ago; rates are up and risk appetite is down. With the recent fall of SVB, other lenders are preparing for an influx of inquiries for debt solutions given that the go-to source of venture debt is off the table. For many companies, this means there are options available, however, getting in front of them may prove challenging given the bandwidth constraints lenders are facing.

Generally, lenders are looking to keep costs as competitive and workable for borrowers as possible, managing elevated rates and keeping funding amounts to levels the broader market will bear.

The cost of debt has risen 30-40%, depending on the type of lender writing the check over the past year. Banks have increased rates more linearly with the fed rates increase, while private credit funds have only modestly increased their rates over the same period of time in order to remain competitive.

The broader net that lenders were casting this time last year to review as many deals as possible has shrunk sizably in comparison. We’ve found lenders are generally getting to a quicker “no” than they were before while remaining aggressive on a select handful of opportunities. In short, when they like something they go all in to win the deal.

What Lenders are Looking for

The profile of companies successfully landing venture debt over the past quarter has also changed. The days of the burn and raise business models are behind us, perhaps temporarily, perhaps for the long term. In any case, companies need to exhibit sustainability.

What does that mean? Lenders want to see a company that can manage costs effectively while still growing, without having to rely on continued equity investment just to stay afloat. Companies that are burning aggressively are quickly being turned away, while those that can show a path to profitability are getting much more attention, even if it’s at the cost of high revenue growth. In general, within our broader network of venture debt funds and bank lenders, we’re seeing the following deal preferences:

- Path to profitability within 18-24 months

- Runway post-debt is 18 months

- Growth is at least 10% Year-over-year

Most Common Use of Funds

1. Deferring an Equity Raise or an Exit

2023 is likely not the year to raise equity…or sell your company. This is driving more companies to raise debt financing to strengthen the balance sheet to continue investing in growth and revisit equity transactions going into 2024.

2. Acquisition Financing

Larger companies are seeing attractive valuations for smaller competitors for tuck-in opportunities – they are using debt to finance those acquisitions over equity funding.

3. Insurance Against an Uncertain Exit

Strong revenue, strong balance sheet – but unsure of what the next 12-18 months will hold. Roughly a third of our clients are telling us they don’t need the capital but they might have a use for it later this year and are looking to raise it now, while they can lock in the most attractive terms

In Summary

Now is likely the best time to start exploring debt options for your company. In the near future, term rates are not likely to drop, valuations are unlikely to rebound, and most lenders have an increasingly narrowed credit window. With SVB out of the market, a major lending option is now off the table for a lot of companies, meanwhile, other lenders are active, but only have so much bandwidth and risk appetite.

It’s common for companies to “keep their options open” to see how sales perform or how an investor may come to the table. However, the reality is if capital is available right now, it is safer in this market to secure it while available, rather than risk waiting too long and finding yourself in a tougher situation later this year.

Thank you for reading…please reach out with any questions.